Are Loan Values Falling Faster Than Property Values?

The question is innocuous enough. After all, notes are typically secured against a property’s future cash flows, so the two should have a near-perfect positive correlation. We know that correlation does not imply causation, though; so, what happens when the value of one becomes untethered from the other? Let’s unpack this.

How Does the Loan Market Look Today?

Experts almost universally agree the coronavirus pandemic will negatively impact the real estate industry, but the question is to what extent. As banks parse through their loan portfolios and attempt to reconcile good and bad debt, they, too, are concerned with the severity of the impact. The commercial mortgage-backed security (CMBS) marketplace highlights a few critical trends from which we can gain some insight.

As the number of property owners who fail to make mortgage payments increases, note values will be impacted. Commercial real estate database CoStar estimates that the market could see 13,000 loans held in CMBS' default over the next two years, which represents nearly 15% of the total outstanding CMBS market. Even more alarming is the fact that multifamily, retail, and office notes make up an overwhelming majority of those projected to default.

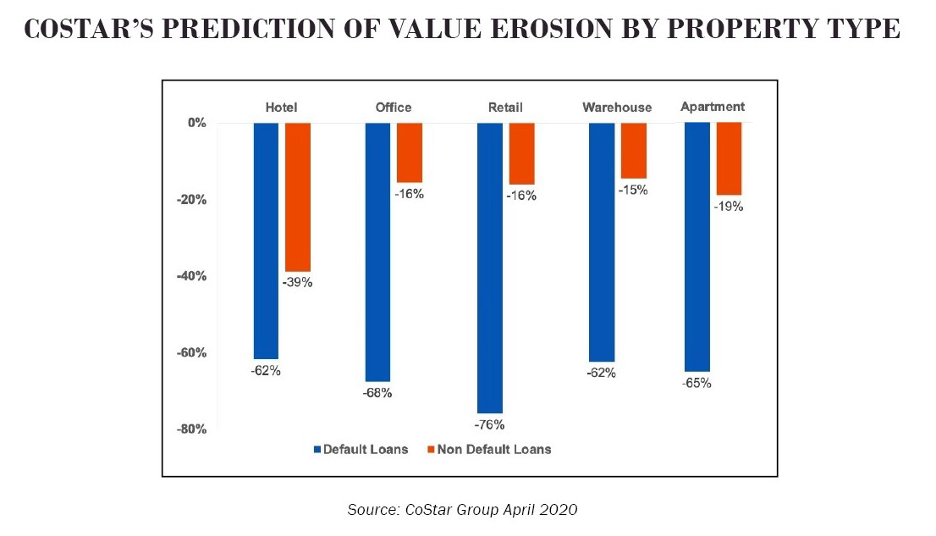

If an underlying note defaults, the effect on its associated real property value would be devastating. Historically insulated markets like Raleigh won’t see the precipitous value erosion that other markets will, but they certainly aren’t immune. Fortunately for lenders, troubled and defaulted debt will be the anomaly as opposed to the norm. To better understand the relationship between property and note values, we must have knowledge of property values under non-default conditions. Value growth in office and retail properties has lagged behind its peers over the last few years, which lends itself to a slightly softer price correction. With that being said, CoStar speculates both product types will see a 16% reduction in value as a result of the pandemic, irrespective of the loan value. The question is whether loan discounts will outpace depreciating property values.

How Are Lenders Getting Ahead of This?

A central tenant of credit management is a lender’s ability to recognize and proactively remedy distressed loans. Banks that carry problem loans on their balance sheet will see disruptions to their cash flow, decreased earnings, and reduced capital for subsequent lending due to increased loan reserves. There are several techniques they use in an attempt to recoup losses from these loans. First, a lender can restructure a loan; this would help maintain cash flow and avoid specific accounting requirements. The CARES Act suspended the GAAP requirements for loan modifications, giving a lender more considerable latitude to modify loan terms favorably. The sale of a debtor's collateralized assets is another approach. This is inefficient, and in a marketplace where we are likely to see a drastic increase in distressed assets, not the preferred method. The orderly disposition of foreclosed properties would be the chief concern, and most lenders cannot effectively manage that process in-house.

Recently, the marketplace saw several large banks write-down their loan portfolios. This is uniquely a balance sheet adjustment, but the action connotes something much more significant. A lender values a note by analyzing its expected future cash flows in terms of today’s dollars. If a firm believes that economic or environmental influences have fundamentally changed the outlook of future cash flows associated with that note, they will need to adjust its book value. It is evident that lenders already believe the coronavirus disruptions have materially affected note values.

A Retail Strip Center Vignette

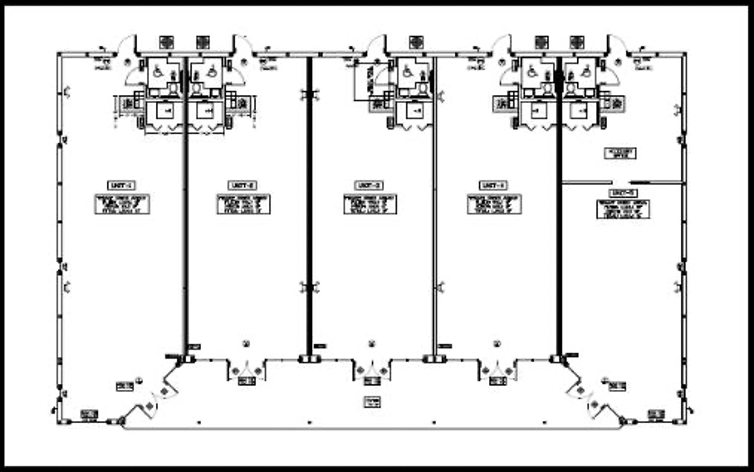

If you're an average retail center or multi-tenant office owner, you may be asking, "so what?" The intricacies of note valuation and balance sheet accounting aren't applicable to a broad audience, and the CMBS playing field is mainly institutional. For the sake of the discussion, let’s use the retail strip center below.

This 5-unit retail strip center is fully leased, and all tenants were up to date on rent through March. Due to the mandatory shutdowns, four of the tenants were deemed non-essential and forced to cease operations. Of those four tenants, two have asked for substantial rent concessions under their lease provision of force majeure. Simultaneously, because 40% of the property’s cash flow dried up overnight, the landlord is seeking concessions from the lender.

If the note is booked at $1 million on the lender’s balance sheet, and two tenants are compromised, what is the loan worth now? $800,000? $600,000? The answer largely rests on what the lender believes that note will generate for future cash flows. The uncertainty of a notes future revenue is driving lenders to write down their portfolios in an attempt to minimize future losses.

Will small business tenants, who typically carry fewer cash reserves, even survive the shutdown? For businesses that do remain viable, how long before they return to pre-COVID-19 levels of revenue? Restaurants may really need to alter operations for years, as draconian max capacity and distancing regulations will erode revenues they enjoyed before the pandemic. We know that on average retail property values will depreciate by about 15%. Rent collection statistics indicate that roughly 50% of tenants are not paying their rent currently, which would suggest underlying note values are depreciating at an accelerated rate.