COVID-19 From a Lenders Perspective

Signs of stress for CMBS loans in the retail sector are mounting, with delinquency rates lagging behind only those of multifamily properties. Why then, even though lenders are busy, have they yet to ratchet up the pressure on debtors?

May 1st is nearly upon us, and the date marks another significant milestone in determining the widespread impact of the coronavirus pandemic on both rent collections and commercial property valuations. Roughly one-third of U.S. apartment renters could not make rent for April, with that number expected to rise drastically next month.

Office and retail collections tell an even more dire story, as Marcus and Millichap estimates that some multitenant landlords have collected as little as 15% of April’s rent due. As rarely used lease provisions like force majeure and go-dark clauses become commonplace amongst “non-essential” tenants, building owners are looking to buy much-needed time from their creditors.

Facilitated by an influx of liquidity and legislative relief from the federal government, lenders have been supportive of the needs of property owners to this point. Many have offered 90-day forbearance agreements or options to pay interest only for the short-term; these agreements have been mostly void of the dreaded right abandonment legal paperwork typically associated with loan restructuring.

Banks have had little time to reflect on the quantitative impact the shutdowns have had on their underlying note and portfolio values. Frantic PPP applications have primarily kept them preoccupied, and the latest round of stimulus funding will only delay the inevitable. How different will the world look in 30 days when lending and credit teams finally come up for air?

How Does the Mortgage Industry Look Today?

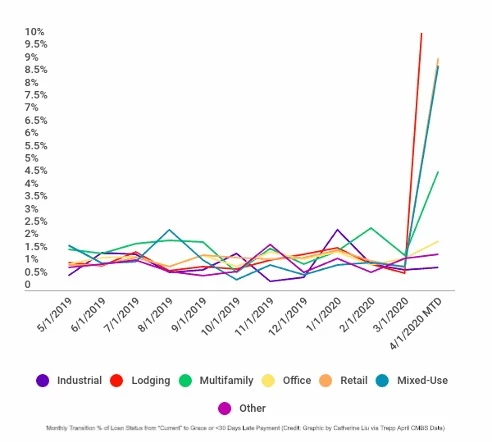

As of April 15th, Trepp reported that nearly $13 billion CMBS loans that had been current in March had gone into or beyond the grace period in April. Credit rating agency Fitch projects a near 20% default rate on U.S. CMBS loans for 2020, with especially vulnerable sectors like hospitality and retail accounting for a large portion of those.

Monthly % Loans from Current to <30 Days Late Payment

Signs of stress for CMBS loans in the retail sector are mounting, with delinquency rates lagging behind only those of multifamily properties. Why then, even though lenders are busy, have they yet to ratchet up the pressure on debtors? The answer is less cynical than many outside the lending community would lead you to believe.

Economic uncertainty hasn’t strictly plagued landlords and tenants; it has hindered a bank’s ability to operate. As the post lockdown world begins to take shape, lenders, like many across the economy, are readying their near-term playbook.

For an owner, the Great Recession delivers insight into how a creditor may approach the next 12 months. Being able to anticipate a lender's actions can serve to level the playing field for future mortgage negotiations. Equally as crucial to a debtor's short-term success is their grasp on loan provisions and how violating certain covenants can cause a note to be called.

Debt Service Coverage Ratio – Why it Matters

When a lender underwrites a loan initially, they are chiefly concerned with a borrower’s ability to repay that loan. Loan repayments on commercial properties are primarily made through the cash flow generated from that property or business. The debt service coverage ratio (DSCR) codifies a property’s ability to meet these obligations through the following calculation:

- NOI or EBITA / (Annual Debt Obligations)

Depending on the type and size of the business or property, most lenders will require the DSCR to remain between 1.2 and 1.5. To put this in perspective, a building that involves loan payments of $100,000 annually would need to generate at least $120,000 of net operating income over that time frame.

With this in mind, most loans carry DSCR covenants, giving lenders the right to review a debtor’s compliance at least annually. If a property owner falls outside of the prescribed parameters, a lender may call the loan payable immediately. What seems like an amicable arrangement today may quickly turn sour as lenders invoke specific loan provisions.

--------

A conversation between the lender and an owner can be tenuous to navigate. As rental income collections become increasingly unpredictable, a borrower's revenue generation may be severely hindered. Technical loan defaults like DSCR covenant violations can sneak up and are challenging to remedy. Owners must be knowledgeable and well versed in their obligations to their lender.