Throw Out Everything You Know About Past Recessions – This One is Different

An unprecedented number of initial jobless claims have flooded state unemployment agencies over the past seven weeks; meanwhile, numerous economists maintain an optimistic outlook on the future of the economy once stringent lockdown regulations are lifted. As of May 7th, new jobless claims topped 36 million, which amounts to over 16% unemployment, dwarfed only by figures recorded at the height of the Great Depression. Increased regulation, stimulus programs, and multiple rounds of PPP funding have helped stymie additional job losses, but at a human and fiscal cost which may be felt for decades.

Uncertainty has ushered in significant stock market volatility, highlighted by prominent indices, Dow Jones and S&P500, hitting 10-year lows during the latter half of March. The market has since recuperated despite the endless barrage of bad news, dismal job numbers, and contracting GDP figures. Bullish economists conflate these rising stock prices with the inevitability of a “V” shape recovery, completely ignoring the probability of the bear market trap in which we likely reside. The coexistence of unsubstantiated market gains and economic contraction presents an inherent paradox and signals a problem with far deeper roots.

The Life Cycle of a Recession

Generally speaking, a recession is defined as a period of negative GDP growth that lasts two consecutive quarters. In reality, the peaks and trough of a business cycle are hard to identify, especially when we don’t have the benefit of hindsight.

A recession is officially declared and dated by a committee of economists with the National Bureau of Economic Research (NBER). They look at four monthly economic data series to make their determination: real income, employment, industrial production, and wholesale-retail sales. Dependent on the extent these indicators show a downturn helps the committee to frame the business cycle and better define the recession.

According to the NBER, recessions since the end of WWII have ranged anywhere from 6 to 18 months, with an average of 11 months. It is important to note, however, that even though academia may only define a recession for 11 months, the negative economic consequences are felt for much longer. As a commercial building owner, a more telling barometer would be the time it takes for real property values to appreciate to pre-recession levels. For instance, the Great Recession was defined as lasting 18 months and hitting its trough in June of 2009, but an all-time high CMBS delinquency rate was recorded as late as July 2012. In many cases, it wasn’t until 2013 that property owners enjoyed pre-recession property values.

So, what does this mean as we stare down the barrel of another recession? Loose economic policy, frivolous capital investment, and the recent bursting of the debt bubble have sent us careening down a path we haven’t traveled; we can’t look back at U.S. history to help us write the ending because we haven’t seen it before.

Why will this recession be different?

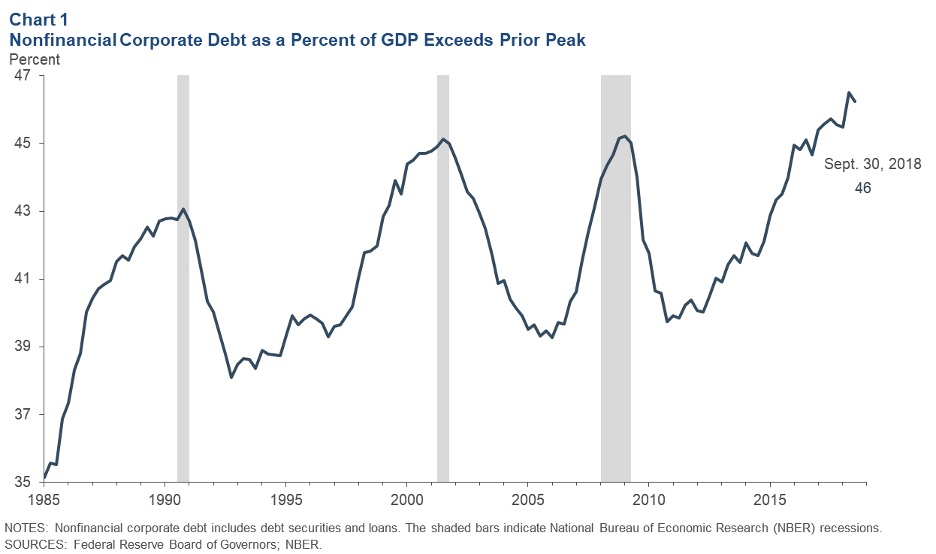

Business cycle downturns are about as predictable as the rising and falling of the sun, but their size and scope can be challenging to forecast. Typically, experts point to an economy’s underlying health, consumer and business preparedness, and overall market liquidity as being critical factors in determining how long a recession may last. Record long expansion, fueled by artificially low-interest rates, has lulled policymakers into a self-aggrandizing vacuum, presenting serious consequences for the market. The coronavirus pandemic was simply the pin that burst the ballooning debt bubble and has exposed the fragility of the system it propped up.

The policy response to the Great Recession established the federal government’s playbook for combatting stalled growth but set the stage for the crisis we now face today. For much of the last ten years, historically low-interest rates have led to excessive capital investment and exponentially higher levels of corporate and consumer debt. Stock prices have become disconnected from companies' underlying value, and increased leverage only leaves them more exposed to an economic shock.

Keynesian economists purport that central planning and artificial interest rate reductions are the cure. With interest rates already near zero, the Fed’s typical strategy is exhausted, and they have instead turned to quantitative easing "infinity" in an attempt to flood the market with liquidity. This manipulation is a self-fulfilling prophecy, though, as debt driven consumption creates a perpetual cycle of bubble creation and busts, resulting in further manipulation. Each subsequent recession will grow in length and severity, and the intricate web of relationships created through debt issuance will mean systemic pain in the marketplace.

Exorbitant government spending and stimulus will only deepen and lengthen the recession as well. The debt bubble cannot be reflated immediately, and unemployment benefits that incentivize a large population of the workforce to stay home will only further issues. Asset prices will fall categorically, but traditionally insulated geographic markets like Raleigh will fare better than others.

When the strict stay at home orders are lifted, and the economy wakes up, the reality will look very different than how it looks today. Fiscal policy can’t prop up this house of cards forever.