Development Financing: How to Finance Your Next Real Estate Development Venture

There’s a saying that real estate development has historically been reserved for only the most affluent and well-connected investors and entrepreneurs.

Those with the deepest pockets and most political connections were often the ones to get projects approved and expedited through city councils and municipal watchdogs.

But as innovation does, the market began to find alternative real estate project finance solutions – paving the way for small-scale developers, business owners, and investors to get in the game.

Yes, real estate development is expensive. And developers often must pledge some of their capital to get a project up and running. But where does the rest of the money come from? Is it debt or equity? How expensive is that financing for the developer?

Securing financing as part of the real estate development process can make or break the feasibility of a project.

We’ll cover that and more as we discuss the ins and outs of developing financing.

What is the capital stack?

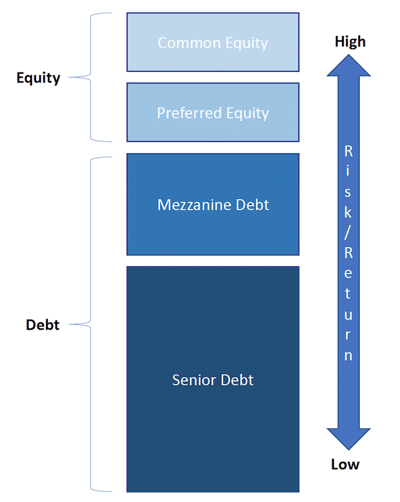

In real estate, the capital stack refers to the layers of financing that make up a project. It usually comprises both debt and equity and highlights the priority at which interested financial parties hold claims for repayment.

The capital stack has 4 main elements – senior debt, mezzanine debt, preferred equity, and common equity.

The graphic above depicts the priority and relative risk levels of each type of financing. Although common equity sits at the top of the stack, it has the lowest priority. This is because it receives a return only after all other parties in the transaction have received their agreed-upon payment.

The most senior debt conversely sits at the bottom, has the lowest risk and equivalently lowest return, but has the first claim for repayment and can subsequently foreclose on a property if the debtor fails to meet their obligations.

Keep the capital stack in mind as we dive deeper into development financing.

Understanding the development process as it relates to real estate project finance

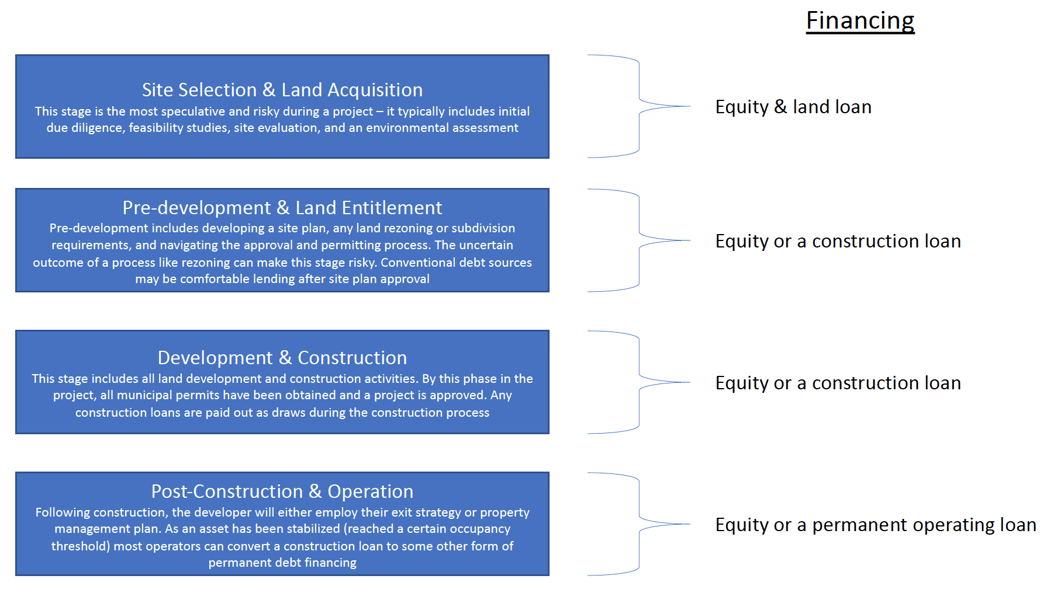

To better understand how the capital stack overlays on a project, we must also conceptualize the various phases of a real estate development. Traditional developments can be broken down into 4 broad phases:

- Site selection & land acquisition

- Pre-development & land entitlement

- Development & construction

- Post-construction & operation

Each stage of development is generally funded by different types of debt or equity, based on the risk and likelihood of a project successfully progressing.

The site selection and land acquisition stage is almost always funded strictly with equity, predominantly the sponsor’s capital. During site selection, a developer is still trying to decide whether the project is viable, if the site can support the proposed project, and uncover any environmental or engineering concerns.

It’s highly speculative – a large percentage of projects never make it past this phase. So more senior debt or equity sources will want to see financial buy-in from the developer.

But as a project progresses, an approved development becomes more and more likely. Milestones like site plan approval, permits, and land entitlement are gates that further increase a project's likelihood of success. And as a project becomes less speculative, more traditional forms of debt financing are willing to commit funding at a lower return threshold.

Variables like property rezoning, subdivision, and land annexation are also hurdles that add uncertainty to a project. It’s not uncommon to see these processes financed by a mix of debt and equity sources.

Types of debt and equity development financing

In traditional real estate project finance, cash flows from an investment must cover operating expenses, debt service, and any other obligations to parties within the capital stack.

Because real estate development projects generally don’t generate cash flows until after construction and property stabilization, development financing is a slightly more complicated concept.

We'll discuss various types of debt and equity development financing options and several creative funding strategies below:

Traditional financing

In real estate development, traditional financing is a broad term – it refers to debt funding and usually is in the form of a loan from a bank.

Depending on the size and risk of a project, a traditional bank note accounts for roughly 60-80% of the project’s capital stack. Therefore, a developer must either fund the remainder of the project through alternative debt sources, sponsor equity (their own capital), or some alternative means of equity financing.

Traditional bank loans can take a variety of forms depending on the phase of a project. For example, land acquisitions can be facilitated through land loans, while land development and construction costs are financed through construction loans in the form of construction draws. And once a property reaches a certain occupancy threshold, construction financing can be converted into a long-term debt instrument.

To qualify for a loan, a bank will need to do its own due diligence to assess the developer’s track record and the likelihood of the project’s success.

Syndicated financing

In real estate, the concept of syndicated financing can be used in several contexts.

A real estate syndication is the aggregation of resources (usually capital) to acquire a piece of real estate or fund a venture. A general partner, who in this case would also be the real estate developer, would structure a deal and court investors (limited partners) to pledge capital towards that project.

However, syndicated financing carries a slightly different connotation and can be facilitated through a lender and is usually capital funded through private equity sources.

In some cases, the developer engages in the fundraising, while other times, a lender will facilitate the transaction for a higher interest rate.

Real estate syndications can take on various structures but usually include some sort of preferred return on initial capital investment (6-8%) and some claim on future capital gains.

Crowdfunding

Equity crowdfunding is a new source of capital that has changed the game for real estate investors, entrepreneurs, and developers.

The Jobs Act of 2012's implementation in 2016 paved the way for the democratization of real estate development, and subsequently, investment in development for non-accredited and accredited investors.

The legislation allows real estate developers to solicit investors with no substantive prior relationship through wholly online mediums like social media. It also gives less capitalized investors the opportunity to invest in projects historically reserved for the ultra-wealthy.

In practice, equity crowdfunding can help a developer bridge gaps in a project’s capital stack – making otherwise impossible projects feasible by offering direct investment opportunities to the general population.

Sponsor equity

In a real estate development, the sponsor (general partner) is an individual or team that takes the lead on a project. They are also colloquially dubbed the 'real estate developer' because they'll take the active project management role, while limited partners (other equity investors) take on a more passive role.

A sponsor will most likely need to outlay their capital during the most speculative aspects of a development project – initial project feasibility, preliminary due diligence, and other site evaluation activities that need to happen before a project can progress.

And because development is expensive, most sponsors don’t have 20-40% of a project’s costs in cash, so real estate developers turn to alternative forms of equity financing.

Joint venture (JV)

A real estate joint venture is a situation where multiple parties combine resources and work together to complete a transaction. Most commonly, a JV is structured between capital partners, but partnerships are not only limited to cash contributions.

Commonly, landowners may contribute their land for a stake in a project – so instead of selling the land to a developer, the property owner will participate in the development at an agreed to "land value."

Joint ventures may also involve a credit or experience partnership. For example, a novice developer may bring on a more experienced party to help navigate the project, or a credit partner may be required to help sign for a project's debt.

Joint venture opportunities are limited only by the willingness to engage in and creativity of a real estate developer.

Mezzanine debt

If you remember, mezzanine debt is senior to both preferred and common equity and subordinate only to a senior debt instrument. As a result, it is more expensive than senior debt from a cost of capital standpoint. Still, it offers real estate developers an option to close the funding gap between traditional financing and sponsor equity.

In practice, mezzanine debt is usually not secured by collateral, and notes typically have a shorter duration than senior debt. But a well-structured mezzanine loan can reduce the developer's capital investment and increase a project's ROI.

Real estate project finance alternatives for businesses

But what if you’re a small business? You're rapidly growing, and most of your excess earnings are being reinvested back into the company to drive further expansion. Maybe you need a new building, and development makes sense, but you don't have 20% required equity to fund a project.

There are a few options businesses can employ to close the funding gap:

Build-to-suit

A build-to-suit is an arrangement where a commercial building is custom designed and built for a specific end-user. The project is usually managed by an investor or real estate developer who covers all development financing. In return, the operating company will sign a long-term lease on the space.

A business sacrifices the benefits of real estate ownership by engaging in a build-to-suit, but it offers a fantastic means of getting a new, custom-built space to operate in.

Minimal cash outlay is required – investors are predominantly concerned that a company is a “safe investment” and has enough cash flow to meet any outstanding debt obligations.

Sale-leaseback

If a business owns its existing property, a sale-leaseback is an option to unlock “stagnant” capital that may be tied up in property ownership.

Effectively, a property is sold to an investor, with the operating company subsequently leasing the space back from the new owner. As a result, the proceeds from the sale can be more efficiently allocated to help close the funding gap for a new real estate development project.

It is often thought of as an off-balance sheet means of financing investment activities.

Private placement

A private placement is an unregistered securities offering made directly to investors. In practice, a private placement is the same as a real estate syndication – the critical difference is that instead of a real estate investor/operator serving as the general partner, a business would take the lead as the project sponsor.

Private placements are usually made through private placement memorandums (PPMs), which outline the proposed use of funds and offering terms.

Operating companies can utilize private placements from investors to bring more equity to a project.

Considerations when securing real estate development financing

Before you jump into a development project, there are a couple of considerations worth examining:

Consider your mixture of debt vs. equity

Without diving too deeply into the nuances of capital structure, developers need to acknowledge that the composition of their balance sheet will impact their ability to finance future projects.

In moderation, leverage is great – you’re using other people’s money, and it can amplify a project’s returns. But you can only sign so many recourse notes until a bank isn’t comfortable lending to you anymore.

So, before you run to the bank to finance your next project, think about your mix of debt to equity and capital structure.

The relative costs of capital

Every type of financing carries an associated cost of capital or the required rate of return. If you remember the capital stack, debt is usually cheaper than equity, with some exceptions.

By funding a project with one type of financing over another, you may be impacting a project’s return on investment.

The process of securing real estate project financing

Developers should expect to navigate a unique set of regulatory hurdles and requirements for each different type of financing in the capital stack. But outside of lender-specific due diligence requirements or SEC challenges, there are a couple of best practices universal to the fundraising process.

Conduct a feasibility study

A feasibility study is like a traditional business plan. It serves as the foundation for a successful real estate development project by assessing all site investigation, research, and preliminary due diligence items against potential pitfalls and associated financial costs.

It also weighs all macro and microeconomic factors that may impact the profitability of a project to include competitor data, municipal specific challenges, and changing economic trends.

A comprehensive feasibility study will offer a developer, and subsequently a financier, greater comfortability with the likelihood of success for a given proposal.

Build development budget & proforma

Real estate development and construction costs are hard to predict, especially in an economy dealing with inflationary pressures and suffering from labor and supply constraints.

But development budgets need to be built early and with a high degree of accuracy, based on 3rd party quotes, historical data, and educated conjecture.

Expect a lender to pour over your budget – they'll want to see cost contingency buffers, a breakdown of development and construction costs, and your expectations for leasing a property up. Investors will weigh their investment decision heavily on the accuracy and comprehensiveness of your development budget and financial analysis.

Stress test numbers in your proforma

What's the likelihood of a project going along without a hitch? We'll let you in on a bit of a secret – problems are going to happen. There is a saying in the Army that the best-laid plans never survive the first contact with the enemy.

But because you know problems are an inevitability, you can plan for them. A stress test serves as a simulation to determine the feasibility of a project under certain economic or environmental conditions. By assigning a probability or likelihood to possible outcomes, you can determine the profitability of a project even under the worst conditions.

Stress tests also help to highlight any errors in a financial model’s underlying assumptions.

Demonstrate credibility

There’s a level of storytelling or salesmanship necessary in pitching an opportunity to a group of investors. But weaving a compelling narrative is only a fraction of the formula for success.

Because the developer is the single point of failure managing the entire project, investors need confidence that the developer will achieve a project's stated goals. Credibility comes in the form of relevant development experience or experience as a co-general partner or investor on other projects.

Developers who lack a track record can partner with a more experienced operator to help their chances of success when funding a project.

Conclusion

Real estate development almost always requires some sort of outside development financing. So if you're a small business with questions about build-to-suit, or an investor navigating the real estate syndication process, Marsh & Partners' real estate consulting services can help.

We've helped investors optimize their balance sheets and secure cheaper funding through portfolio recapitalizations and helped businesses unlock capital and finance future development through a sale-leaseback.

We’ve even built a comprehensive library of real estate insights and exclusive resources to help businesses and investors learn more about the industry and achieve their wealth goals.

If you have specific questions or just want to kick ideas around, we’d love to chat.