The Future of Real Estate With Blockchain Technology

Most people know blockchain technology in the context of cryptocurrencies.

But, more recently, the NFT craze in 2021 brought some of this technology, and its unique lexicon, back into the mainstream discussion.

It used to be that these technologies were reserved for the early adopters. But a domain once dominated by Silicon Valley entrepreneurs and millennials no longer remains so, and now investors of all demographics are getting in on the action.

Blockchain technology has already begun revolutionizing services we use and enjoy daily – you might not even be aware of it, but your bank probably already leverages it. Even supply chain and logistics companies and the music industry use blockchain technology daily.

Now, before your eyes begin to glaze over, this post isn’t going to be filled with technical jargon. But I want first to define blockchain technology quickly to set the stage for the rest of the discussion on how it will impact the real estate industry.

What is the blockchain?

In layman’s terms, a blockchain is a decentralized public ledger that lives on a network.

A blockchain serves a similar function as a traditional database but offers more robust security by storing information electronically in a digital format.

Information stored in a blockchain gets lumped into groups and eventually stored in "blocks" of data, making up the blockchain.

No single person or group controls the information stored on a blockchain. Instead, computer nodes on the network validate the transaction before it's posted, ensuring the validity and immutability of the information.

Once stored on a distributed ledger, transactions and information become permanent and viewable by everyone.

But what does this all mean?

It means that there no longer remains a single point of failure for information storage.

The days of server farms and warehouses full of computers will soon be a thing of the past.

A power outage or physical security breach won’t spell disaster – information is decentralized across various network nodes at multiple locations.

Curious how this all applies to real estate? There are several ways that the blockchain will change real estate forever.

Tokenization

Real estate tokenization is the process of converting real estate into a virtual token on a blockchain. The token represents a particular share of ownership of the underlying real estate asset.

Real estate tokens are similar in concept to other securitized assets or stocks and shares of a company, except they benefit from living on the blockchain.

The inception of tokenized real estate has significant implications for the real estate industry for several reasons:

1. Liquidity

Think about how easy it is to buy and sell cryptocurrencies in the marketplace. Crypto can be bought and sold using fiat currencies, traded for goods and services, and sold peer to peer and through 3rd party intermediaries.

Real estate tokenization can simplify deals and allow for transactions like purchasing and selling other cryptocurrencies and securities.

2. Proof of ownership

Traditionally, real estate ownership is represented by the trail of legal documents that show the history of sales and transactions for a given asset.

But that trail of ownership documentation is archaic and can often be misleading - deeds may be improperly recorded, ownership forged or fabricated, or a property may have an unknown lien. Those title issues could all, unknowingly, fall on a buyer if not adequately handled.

On the other hand, because tokenized real estate lives on the blockchain, and the blockchain is a decentralized distributed ledger, all transactions are validated and made public.

There won’t be any issues that arise from various ownership claims, any liens would be publicly available, and title forgeries would be next to impossible.

3. Decreased transaction costs

Real estate tokenization and peer-to-peer real estate transactions can considerably lower transaction costs associated with the purchase or sale of a property.

Most real estate closing costs are comprised of fees and payments charged by 3rd parties and transaction service providers – but once those intermediaries are no longer required, tokenization will allow investors to buy and sell real estate without incurring those costs.

Smart contracts

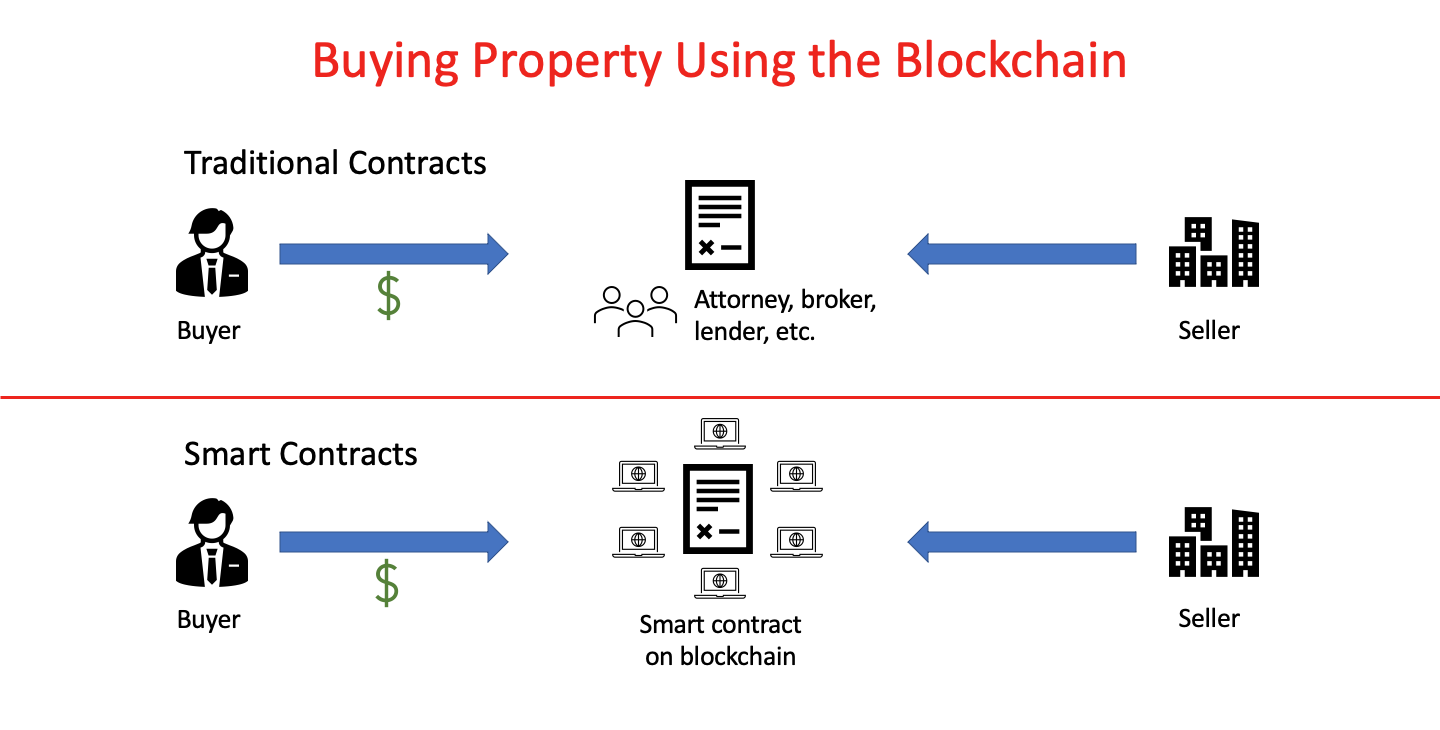

Smart contracts are transactions that are automatically executed when a set of predetermined conditions are met.

The contract terms are written as lines of code, and transactions are stored on a blockchain. This serves to automate the execution of an agreement without any intervention or overhead from an intermediary.

Once specific criteria are met, smart contracts can trigger a workflow that automatically advances and initiates the following action in a series of steps.

When you begin to understand smart contracts and their widespread applicability, it's not so great of a leap to realize how they’ll disrupt the real estate industry.

From purchase contracts to letters of intent (LOIs) to closing documents, real estate investors will no longer have to meet and negotiate with brokers, pass paperwork back and forth, or deal with transaction overhead.

From purchase contracts to letters of intent (LOIs) to closing documents, real estate investors will no longer have to meet and negotiate with brokers, pass paperwork back and forth, or deal with transaction overhead.

The speed and accuracy at which transactions can occur compared to the friction in the process we deal with today will be staggering.

And with no intermediaries and the benefit of encrypted blockchain code, the transparency and security of contracts will no longer be in question.

Liquidity

Real estate is an illiquid asset.

Sourcing quality deals is complicated. Extensive due diligence may be required, and it takes time for paperwork to be drafted and sales to conclude.

And brokers, attorneys, and other intermediaries and service providers only add friction and uncertainty to a deal.

But with real estate transactions on a blockchain, a seller doesn't need to wait for a single buyer to afford the entire property.

Instead, shares of a smaller ownership percentage can be sold to buyers for a fraction of the price of the entire real estate. And that ownership stake in property can be much more readily bought and sold.

Additionally, the transparency and decentralization of tokenized real estate make it much easier for real property to be traded on exchanges. Transactions may be completed wholly online without the need for face-to-face meetings, in-person signings, or long antiquated legal processes.

The speed at which real estate can be transacted on the blockchain will completely revolutionize how we buy and sell property.

No intermediaries

Real estate industry service providers have long been a part of the real estate transaction ecosystem – brokers, attorneys, lenders, title companies, etc.

But with the advent and prevalence of blockchain technology in real estate, those traditional roles will take on an entirely new scope and may soon become obsolete.

Smart contracts will replace much of the required legal work and contractual-specific arrangements.

Decentralized listing services will give potential buyers a much better picture of what’s available for purchase, without the barriers to entry presented by real estate agents.

Title work and ownership documentation will be stored on the blockchain – easily verifiable and visible to any 3rd parties. This will also make reselling and future property transactions much more efficient and trustworthy.

Cutting these intermediaries out of the transaction will save on closing costs, fees, and commissions and substantially reduce the time it takes to get a deal closed.

Comprehensive & transparent listing services

Despite the antiquated business model, one of the biggest reasons real estate agents still have such a stranglehold on the industry is the Multiple Listing Service (MLS).

The MLS has an unofficial monopoly on residential and commercial real estate listings – offering access to agents and real estate professionals only for a princely sum. As a result, potential buyers and sellers have little visibility of what is on the market for sale and, therefore, little control over the procurement and sale process.

Free platforms have attempted to disrupt the cartel, but they’ve seen little success in carving out any substantive market share.

But with the disruptive decentralization the blockchain offers, consolidated listing services will no longer add any value – other than as large repositories of aggregated data.

The blockchain can enable online trading platforms and marketplaces to facilitate real estate transactions.

Companies like UVAS & ATLANT have developed platforms that list properties and allow for the purchase and sale of real estate, including leasing and rental property transactions, using the blockchain.

As a result, real estate is treated and traded much like stocks on an exchange. Sellers have access to a much larger pool of potential buyers, not hindered by geographic-specific MLS's or exchanges.

Asset democratization

Thanks to tokenization and blockchain technology, real estate assets can now be broken up into smaller ownership sizes.

It used to be that investing in a real estate syndication was the only way to get in on the action as an investor with limited capital. Then the JOBS Act of 2012 offered another medium to invest in real estate through equity crowdfunding.

The blockchain further democratizes investment in real estate by reducing the capital barrier to entry for everyday investors. Fractional ownership allows investors to break into the investing space with significantly less money upfront.

Imagine instead of having to purchase an entire piece of real estate, you can rather invest in 1/10th of the property. Not only does this minimize your required capital, but it also helps singular investors avoid some of the property management headaches by pooling the risk.

Fractional ownership will allow investors to better diversify their real estate portfolios and hedge against ownership risk more effectively.

Leveraging a real estate consultant to get a leg up

Blockchain technology has the potential to upend the way we interact with real estate entirely.

But as with any significant technological advancements, there will be resistance. People are naturally averse to technological changes, and the brokerage and attorney communities and their associated lobbies will likely present staunch opposition.

There will be obstacles to widespread adoption. But a real estate advisor with an understanding of how these worlds intersect will be crucial to maximizing the value of existing and future real estate.

Real estate developers can begin using tokenization to help raise capital for development projects – with shares representing an ownership interest in properties under construction.

The way investors value, hold, manage, and exit properties will be completely different.

No longer will real estate be beholden to time-intensive and costly verification proceedings or needy service providers and siloed databases.

If you’re interested in discussing this technology or brainstorming ways you can better prepare for the future of real estate, let’s chat.

Book some time on our calendar here.