When Is the Right Time to Sell Your Land as a Landowner?

One of the biggest challenges as a real estate owner, especially during periods of economic uncertainty, is determining when it’s the right time to sell a property.

That isn't to suggest you try to time the market perfectly. Unfortunately, none of us have a magic eight ball, and too many investors and property owners have been burned trying to predict future price movements.

But to determine when to sell a property, it's essential to understand what factors influence the value of your land to time your exit properly.

So, let’s briefly talk about real estate values. You can also check out our complete landowner page here for more great resources on making smarter, more profitable land decisions.

A crash course on real estate valuation

Valuing real estate with an existing building is pretty straightforward – an investment property's value is largely based on the income it produces. And suppose it's an unoccupied or owner-occupied building. In that case, comparable property sales and supply/demand dynamics largely dictate the property value.

So as a real estate owner, it's relatively simple to determine how much your property is worth at any given time, which helps inform your decision on when it makes sense to sell your asset.

But land poses several unique challenges. It's generally not income-producing unless there is some sort of existing land lease on the property. And the comparable sales approach isn't adequate in determining land value. Every parcel offers unique challenges – estimating sitework and land development costs can be a significant variable, and a property's "future potential" has as much to do with present value as its current use.

Critical land feasibility criteria like a parcel's zoning and allowed land use, associated land entitlement risks, access to utilities, required off-site improvements, and environmental considerations can vary greatly even across neighboring or nearby land parcels.

Raw land is also often susceptible to macroeconomic and local market effects and political influences – factors generally out of the property owner's control.

All these unknowns make land valuation extremely difficult. And because the price is critically important to a property owner in their decision to sell their land, it makes timing the decision challenging.

Consider, too, the major market disruptions we've experienced over the last couple of years.

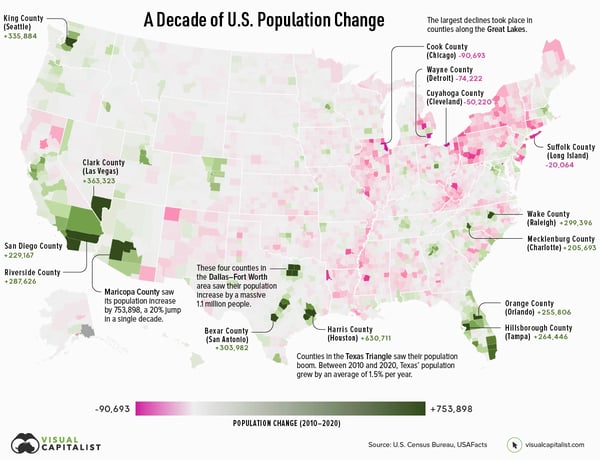

COVID changed people's work and living habits. As a result, we've seen a once-in-a-generation domestic migration – an exodus from cities and regions essential to American life into emerging cities and new geographic areas.

And understandably, significant change brings about uncertainty. It raises questions like:

- When is the right time to sell my land?

- Is the market going to continue to appreciate?

- Am I getting top dollar for my property?

- Should I be selling my land to a developer or an end-user?

They’re important questions to ask. The answers are informed by the various internal and external forces that guide the decision to sell a property.

Below we'll cover the most important factors that landowners need to consider when picking the best time to sell their land.

Understand cultural shifts & macroeconomic dynamics

How people live, work, and play impacts how they interact and cohabitate with the real estate around them - and as cultural shifts occur, our preferences change.

Government-mandated COVID lockdowns accelerated an existing trend towards more flexible and remote work options. That, in turn, forced people to spend more time at home and ultimately flooded the market with eager homebuyers looking to migrate out of dense urban areas and more lockdown-prone states.

That, coupled with historically low-interest rates, led to an unprecedented supply and demand imbalance and record real estate price appreciation.

Land in secondary and tertiary markets was gobbled up at rates never before seen in history. Homebuilders set their sights on build-to-rent neighborhoods and land outside major cities – land prices in many areas soared.

But as with every boom/bust cycle, the tides are turning again. Rising interest rates have eroded would be buyers’ purchasing power. And existing homeowners are having a hard time justifying selling a home with a 2.5% mortgage into a property with a 7% note. So, as a result, supply remains low, but the potential buyer pool shrinks.

What does this all mean for the value of your land? It's certainly not the first time we've seen significant market disruptions over the decades.

The democratization of automobile ownership resulted in the urban sprawl of the 20th century and an increase in suburban and rural land values outside of cities. The pendulum swung again with the urban revitalization of the 2000s and a focus on walkable mixed-use development.

All of these factors can impact the value of a property. It's expected a property's highest and best use may evolve based on what's happening around it. So it's critical to understand how these cultural shifts and market dynamics impact land value.

Understand the path of growth

Just as cultural shifts impact the value of a property from a macroeconomic perspective, localized market dynamics affect the path of growth within communities.

Development becomes more challenging and time-intensive as areas become more densely built out. And as the barriers to entry increase, the future potential of a project also increases, and transitively the value of the land would increase.

So as a landowner, if you understand a market's growth path, you can potentially capture a greater value for your land than you would have otherwise.

An inflection point exists between land value and the path of growth, though – as development becomes more challenging, the potential buyer pool will shrink. And generally, the more cumbersome the development regulations that govern a piece of land, the longer it will take to sell a property.

There’s a potential downside to waiting too long to sell a piece of land. Landowners need to weigh their speed and desire to sell a property vs. their need to maximize land value.

Should you sell your land "as is?" Or work to maximize its value (highest & best use)

Euclidean zoning is a planning concept that divides areas into separate zones with specific allowed land uses.

That means that contrary to what we've been led to believe from an early age, you can't do what you wish on your private property.

But land-use regulations create inefficiency within the planning and development communities. And that inefficiency creates an opportunity for those who know how to exploit it.

Are you inclined to spend the time, effort, and money required to change your property's allowed use into a potentially more profitable and better opportunity?

If your ultimate goal is increasing the speed or ease of property sale, it may make sense to sell a vacant piece of land “as is.”

If you’re instead motivated to try to maximize the price of your property, consider adding value through land entitlements.

Real estate appraisers define a property's highest and best use as "the reasonably probable and legal use of vacant land or an improved property that is physically possible, appropriately supported, financially feasible, and that results in the highest value."

In layman's terms, that means that as the owner, you can modify the use of your property to attract a higher sales price – possibly by converting residential into commercial land or by rezoning a property to allow for higher density and more profitable development. And that all comes back to land entitlement.

If you’re unfamiliar with the process, our land entitlement guide offers landowners, real estate investors, and business owners a crash course on the real estate development process.

There is significant value in getting a property entitled for a more profitable use, but even more value in getting a property approved for a specific project. Maximize your land value by navigating your property from initial real estate due diligence through an approved site plan to sell the land to a real estate developer or builder on the back end.

Where are we in a real estate cycle?

Real estate and business cycles are an unfortunate byproduct of an economy managed by central planners and a consolidated monetary authority.

With real estate cycles come periods of rapid growth but also periods of steep and sometimes prolonged declines. Understanding where we are in a real estate cycle is essential to know how the value of your property may change over the near term. Additionally, it's vital to anticipate how the government and central planners may react to such economic disruptions. Whether it be quantitative easing (QE), buying up mortgage-backed securities (MBS), or flooding the market with liquidity – often the government response has a more significant impact on real estate values than the market downturn itself. An economy flush with more money and easy-to-access credit lead to a larger pool of potential buyers and asset price appreciation.

And while it's impossible to time the market, history offers insight into how real estate reacts during market changes which can help you make smarter timing decisions.

If you're interested in learning more about recessionary cycles in real estate and investing in real estate during a recession, you can check out our video below.

Changing goals and life events

Real estate owners have always been prime targets for estate planners. Without adequate preparation, families and heirs can be left with substantial tax burdens on the property without the liquid assets to make the payment.

This makes it especially important for landowners to carefully consider their long-term and estate plans and craft a real estate strategy that aligns with those goals.

Another factor to consider is that real estate decisions become increasingly difficult as more parties have an interest in a property. For instance, as more siblings and spouses get involved, making consensus decisions is less likely, and real estate frequently becomes a point of contention within families.

It's challenging to equitably transfer illiquid assets to multiple parties – in some circumstances, it makes sense to sell a piece of land and pass down cash instead of the property.

Aside from estate considerations, different seasons of life call for different goals and priorities. Maybe as retirement nears, you're more inclined to own real estate that offers passive rental income. You might consider selling your land, capturing the value of appreciation over the life of your owning the asset, and instead buying into an income-producing commercial property. You could even consider conducting a 1031-like-kind exchange to defer any capital gains you would have experienced on selling the land.

The bottom line is there's a lot to consider when aligning real estate ownership and major life milestones. Fortunately, there are strategies to help you optimize your real estate and maximize the value of your investments.

How a real estate development consultant can help

The real estate business has evolved into a series of standalone functions. They often deliver services according to their priorities – real estate agents help negotiate and prepare paperwork, civil engineers understand land planning, architects understand design, and contractors are experts in building and construction.

But this creates a poor alignment between those service providers and their clients. For example, in the case of a landowner, it means that you'd need to potentially consult with five or six different 3rd parties to understand better when it's the right time to sell your property and how to maximize its value.

Instead of this antiquated model of misaligned incentives, a real estate consultant draws on expertise that crosses over various real estate and business functions.

And this may sound overwhelming, but it doesn’t have to be. Marsh & Partners’ real estate consulting services can help you determine the best time to sell your land at the most value.

Book some time on our calendar if you're interested in kicking around ideas or want to learn more.